Will Telecom Companies Survive Jio Effect

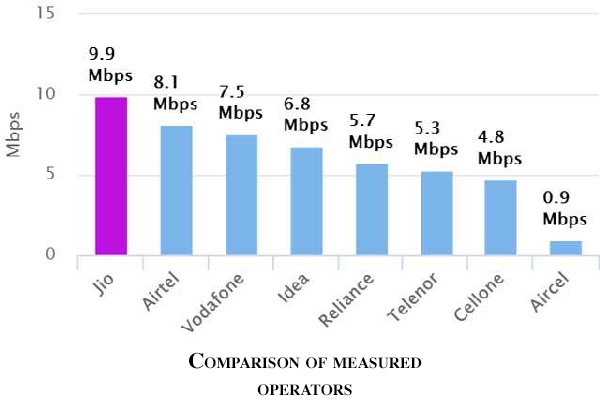

The most eye-catching event took place in the digital industry last year with the Launch of JIO by Reliance Group.

The Mukesh Ambani-owned operator JIO since its inception on 5th September, last year acquired 72 million subscribers in just four months from its launch. In a price-sensitive consumer base country like India, people responded tremendously to the cheap data services, free calls and messages. The company announced its 4G VoLTE services to consumers on September 5th and offered free access to data and voice calls till December 31st. The company then announced ‘Happy New Year Offer,’ which extended the offer till March 31, 2017. Having Amitabh Bachchan and Shah Rukh Khan as brand ambassadors, JIO is not leaving any marketing strategy on a weak note to lose its trustability and popularity among customers and is enjoying the 5 crore subscribers in the club. According to some people familiar with the developments in JIO and as well as analysts, JIO may extend free offers until June 30 at a nominal rate. Will now be charging INR. 100 for data, whereas the voice calls and messages will remain free.

The most evident effects are seen on the other telecom operators in the form of fallen market share and customer base. “Jio has disrupted industry pricing more than we imagined, with consequences for incumbents likely more difficult than we expected,” said George, General Manager, Marketing, Jio, who trimmed his price target on Bharti Airtel to INR 290 from INR 335, and that on Idea Cellular to INR 85 from INR 100.

Idea shares fell 3.4 percent, India’s largest wireless player Airtel slid as much as 1.4 percent. Other telecom companies are coming up with new pricing policies and slashing out the pricing for data plans so as to save them from the effect but, the recently gained popularity brand JIO leaves no room for leverage and mercy for even the big telecoms.

As an effect of Jio, Vodafone has recently announced as much as four times more data for prepaid Vodafone supernet 4g customers. According to Vodafone’s new offer, INR 150 data pack will offer 1gb of data with a validity of a month, INR 250 pack will provide 4gb data while INR 1,500 data pack will give 35gb of data in a month.

Till now the consumption pattern observed regarding switching over Jio networks from current networks regardless of the less connectivity at times and network issues explains the customer’s satisfaction towards Jio. Also, with the news of increasing Jio towers and better network connectivity promised by Mukesh Ambani, in the coming future, customers see it to be more promising. And other Major telecom companies no matter of their strong credibility, revised pricing policies and trustability are losing customer retention over Jio. All eyes are now waiting for the 31st march to see the companies next strategy and to see how other competitors will cope up with this market war.