SBI writes-off loans worth Rs 7,000 crore

While the public stands in queues for petty cash India’s largest public sector bank has dropped more than Rs 7,000 crore, more than 80 percent of the amount owed to it by its top 100 defaulters, into the Advance Under Collection Account (AUCA) bin for toxic loans.

In layman’s term SBI moved all of its unpaid loans into a different account- The Advance Under Collection Account. The people whose loan is moved is of special interest to the case.

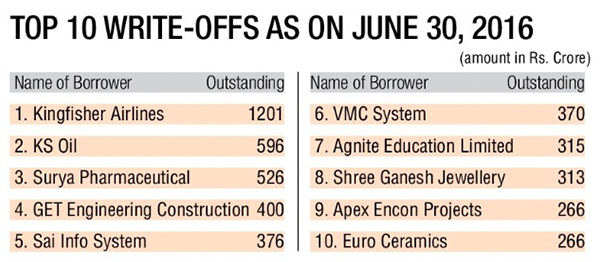

The top five defaulters include Kingfisher Airlines which owes SBI Rs 1,201 crore. The second highest defaulter is KS Oil, once a leading edible oil player under the brand names Kalash and Double Sher in the mustard oil segment, turned defaulter and got added to the top 20 list of write-off accounts. It was declared NPA in 2013 with effect from September 30, 2011. As with Kingfisher, the recovery effort was futile as e-auction of five units failed due to lack of bidders.

The third in the list of write-off accounts, Surya Pharmaceutical, was named a willful defaulter in 2013. The company allegedly indulged in fraud, diversion of funds in retail and education sectors. Ajay Kumar Vishnoi’s promoted GET Power Ltd was declared willful defaulter on August 23, 2016. The company’s mismanagement and the delay in projects led to trouble for the promoters. The fifth in the list, Sai Info, has dues of Rs 375 crore and was declared willful defaulter on August 26, 2016.

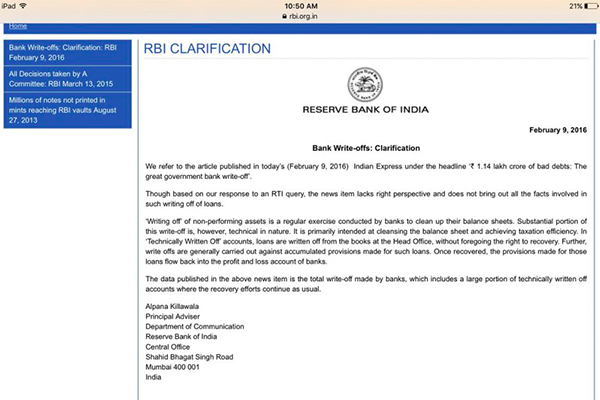

So has SBI really let go of these loans? Not really. Write-offs don’t mean that the loan has been dissolved or that the collection process will stop. A write-off is simply a movement in balance sheet. Because non-performing assets are dead, banks usually use write-offs to better portray their current financial situation. Hence write-offs are a purely technical, accounting entry.

The loans in AUCA account will continue following recovery procedures. But then usually in cases like Mallya’s recovery of money is impossible and if this move betters the position of SBI, then there is no harm in it. The movement into AUCA accounts is also a tool approved by the RBI.

The defaulters will continue to be in the spotlight if not on the balance sheet.