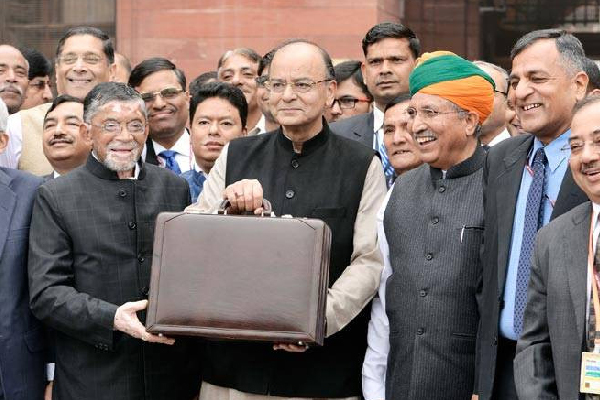

Budget, which carries the charm of ‘most awaited’ announcements of the year, was finally unveiled and make public on an auspicious day of Vasant Panchami at 11 am of February 1. However, the Union Budget presentation overcame the shadow of a doubt, aroused due to unfortunate passing away of a sitting Senior Kerala MP, E. Ahamed, was ultimately facilitated with due respect.

The Union Budget 2017-2018 was ‘momentous’ in many ways. As for the first time, since the inception, Railway Budget was amalgamated with General Union Budget.

It was the first budget execution after striking demonetization step, breached the long-standing British-era legacy of presenting the Union Budget on the last working day of February.This was the first time that the finance ministry has gone paperless for the Budget, and there will be no plan and non-plan distinction in the financial bill (because of an abolition of the Planning Commission).

The broad agendas of Budget 2017 were proposed under ten distinct themes-

The farming sector, The rural population, The youth, The poor and underprivileged health care, Infrastructure, The financial sector for stronger institutions, Speedy accountability, Public services, Prudent fiscal management and Tax administration for the honest.

The ‘momentous’ 2017-18 budget was readily exposed to abundant expectations, in view to spotlight panning from agriculturalist to industrialists. So what is your relationship status with proposed Budget – amity or enmity, let’s find out here.

Poor and Agriculturalists

“Farmers are the only indispensable people on the face of Earth”

Prime Minister Narendra Modi coined the term ‘uttam’ (perfect) for Budget in view of benefits proposed for strengthening the hands of farmers and poor. Crop Insurance, irrigation and marketing of agriculture products are three sectors that received maximum focus in the budget. With that view, some of the tremendous measures were raised in favour of our ‘Annadatas’ (अन्नदाता, food providers) and village inhabitants.

What budget has brought for you?

The government has enlightened this sector by sufficed allocation of funds, favourable channelization towards NABARD, irrigation facility, insurance of soil and credit generation.

Poor were loaded with overwhelming promises and hopes of bringing them out of poverty, providing highest allocation for MGNREGA since its inception, a decade ago, increasing women participation, increasing bond between villages, poor and technology, hope of providing home for homeless, assigning more funds for improvement of roadways and enhancing sanitation in villages as a part of Swachh Bharat mission.

Budget’s Inside (The Flip-Side)

In spite of the announcement of highest ever allocation for MGNREGA, at Rs. 48,000 crore, the important caveat here is that a substantial amount may end up in clearing pending liabilities to the tune of Rs.14,000 crore.

Budgets say that the rabi sowing acreage numbers have increased, while clearly ignoring the low-base affecting arising due to a normal monsoon, following two successive drought years.

No much-hoped debt waiver for farmers

No clear roadmap on how farmer’s income will be doubled in five years.

YOUTH

“The youth is the hope of our future”

When youth holds a countries’ future, how the budget has covered them, becomes an important aspect of coverage.

What budget has brought for you:-

The government’s effort to provide a platform for 350 online courses through Swayam platform can be visualised as the sole welfare initiative in the education sector. Other than it, linking institutional autonomy to ranking, steps planned to create 5000 PG seats per annum, 100 India International centres across the country, Courses on foreign languages etc. also earned youth’s praise for the budget.

Budget’s inside (The Flip-Side)

The budget has promised to introduce a system of measuring annual learning outcomes; this will foster local innovation in backwards clocks of the country. Experts, however, have taken the proposals with a pinch of salt. As measuring learning outcomes will focus on the ends, not the means.

The allocation for education did not show any significant expansion, remaining stagnant as a percentage of the GDP.

Allocations in the Union Budget for education, disability and child development are not enough. All those working in these sectors weren’t satisfied much.

The budget has barely focused on elementary education.

Tax Administration For The Honest

“Don’t tax my income, tax my consumption”

The most anticipated and count on the announcement, for which India was holding its breath high, came in the final quarter of Arun Jaitley’s Budget Speech.

What budget has brought for you:-

If you earn between Rs 2.5 lakh and Rs 5 lakh annually- you will have to pay 5 percent tax on your earnings, as compared to 10 percent earlier, from next year, you will have to fill a simple one-page Income Tax Return form If you are filing income tax returns for the first time, you will not be subjected to any scrutiny for the first year.

- If you earn between Rs 5 lakh and Rs 10 lakh annually-

No change in tax slab, so you will continue paying 20 percent tax on your earnings - If you earn more than Rs 10 lakh annually

No change in tax slab, so you will keep paying 30 percent tax on what you earn - If you earn between Rs 50 lakh and Rs 1 crore annually

From now on, you will have to pay a surcharge of 10 percent over and above the 30 percent tax rate on your earnings. - If you earn more than Rs 1 crore a year

You will continue paying a surcharge of 15 percent.

Budget’s inside (The Flip-Side)

In nutshell, there was only a minor relief for the salaried class, while there was some bad news for the super-rich.

Under Privilege Health Care

“Access to good health care shouldn’t depend on where you live”

In India, still, there are many people who can’t get basic health facilities, under such circumstances it would be interesting to know, the government’s take on the same.

What budget has brought for you:-

“Sabka Saath Sabka Vikas begins with the girl child and women”.

With this notion in mind, the government has justifiably taken care of many schemes, framed to serve them. Whether it is about fund allocated for Mahila Shakthi Kendras or scheme for pregnant women, the government proved that according to promise, expected results in health were amply delivered. Other major proposals include:-

- Elimination of tuberculosis by 2025 targeted.

- Health sub-centres, numbering 1.5 lakh, will be transformed into health wellness centres.

- Two AIIMS will be set up in Jharkhand and Gujarat.

- Will undertake structural transformation of the regulatory framework for medical education.

- Allocation for Scheduled Castes is Rs. 52,393 crore

- Aadhaar-based smart cards will be issued to senior citizens to monitor health

Budget’s inside (The Flip-Side)

With a marginal increase in health allocation made in the budget, the target of eliminating lala-azar, filariasis and measles is more of an ambitious project.

The Health Ministry has set itself the target of eliminating tuberculosis when the latest World health organisation (WHO) assessment revealed that India will not be able to tackle TB even by 2050.

Health experts say that the increase of 23% in the budget, most of which is towards the front runner program, National health Mission, makes these targets unrealistic.

There is no announcement regarding granting healthcare industry the status of infrastructure industry, a long-standing demand of the sector.

Infrastructure And Railways

“The Indian Railways Will become the growth engine of the nation’s ‘Vikas yatra’”

The budget was termed “historic” due to the fact that after 92 long years, it was for the first time that the railway budget was presented with general one. However, Union Minister Arun Jaitley took just three minutes to deliver bulletin on the health of this unique institution.

What budget has brought for you:-

Infrastructure in total received Rs. 39,61,354 crore and Railway in specific was admitted with Rs. 1,31,000 crore. Due to the fact that many fatal railway accidents occurred during recent days, Raksha coach was accentuated. More targets include- Unmanned level crossings, elimination of service charge on tickets booked through IRCTC, SMS-based ”clean my coach service, New Metro rail policy etc.

Infrastructural lucrative include- Rs. 64,000 crore allocation for highways, High-speed Internet to be allocated to 1,50,000 gram panchayats etc.

Budget’s inside (The Flip-Side)

Infra spending is one of the key elements of India’s investment story and Budget 17–18 did well to retain the focus on the sector with a host of positive announcements.

The real estate sector, which has seen a sluggish environment in the wake of demonetization, has received much-needed relief. Conferring “infrastructure status” on affordable housing will give the sector access to flexible and low-cost funding options apart from profit-linked tax incentives.

The Budget, however, has not emphasised on the requirements for promoting competitive manufacturing. Perhaps, it is an opportunity lost for Make in India programmes, especially in areas like defence manufacturing with static CapEx outlay.

“The fact is that for the first time since 1951, when the Railways were last reorganised, the passenger earnings this year are lagging behind the previous year’s performance. Even the freight earnings are lower than last year’s, a situation which roiled the Railways last in 1978-79. It was expected that the Finance Minister would write a harsh prescription to exercise the ghosts bedevilling the Railways’ performance. Alas, our fondest hopes were belied”- Former Chairman of Railway Board, Vivek Sahai shared his disappointment with The Hindu

The deaths on the tracks of the Mumbai Suburban network are another area crying for attention.

Investors

“The stock market is the device for transferring money from the impatient to the patient”

The budget has sent positive signals to investors and it has been evaluated as the best budget since 2005 (for Sensex).

What budget has brought for you:-

- FDI policy reforms – more than 90% of FDI inflows are now automated.

- Foreign Investment Promotion Board will be abolished.

- Negotiable Instruments Act might be amended.

- Computer emergency response team for financial sector will be formed.

- Revised mechanism to ensure time-bound listing of CPSEs. Etc.

Budget’s inside (The Flip-Side)

The government has chosen to allocate a modest Rs.100 billion for recapitalizing public sector banks, which may prove inadequate.

Abolition of FIPB and retaining the tax structure with respect to capital gains extending the tax provisions relating to INR denominated bonds till 2020 etc. are important for development programmes outlined by the budget.

Conclusion

In spite of a major question left unanswered in the budget, which asks that- How in the wake of “Demonisation ki Leher” government will guarantee Cyber security? Then also a pleasant and well-balanced financial bill was presented in Lok Sabha.

It has been observed that the Finance Minister has laid out a very safe Budget this year. It’s a budget which brought little of something for everybody and leaves no one in utter disappointment.