Trump’s investigation overshadows his more dangerous policies

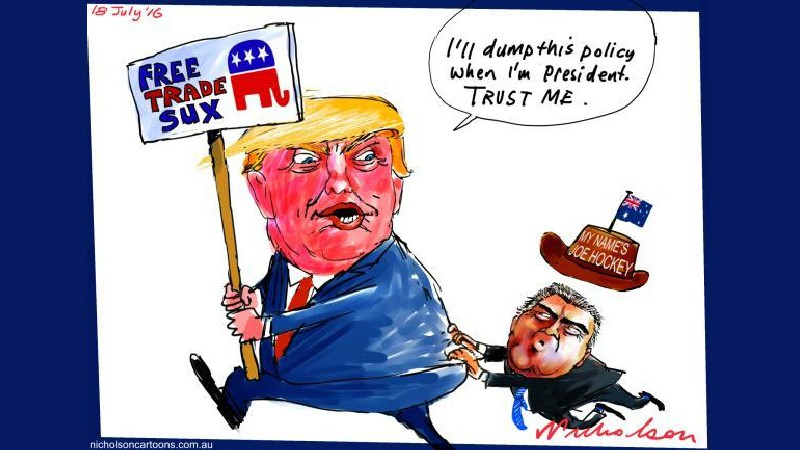

Since billionaire real estate developer Donald Trump became president of United states of America there’s a certain uncertainty regarding United States trade policies. His campaign was fueled by fumes of protectionism. The markets are on a roller coaster ride with its track and destination unknown.

He claims to end the North American Free Trade Agreement between Canada, Mexico and USA. He plans on building a wall along with Mexico’s border to stop immigrants from entering the USA. He decided to pull out from Trans Pacific Partnership that Obama worked so hard to conclude.

He aims to bring jobs back to the USA that China has stolen from them. He’s been accusing China and Japan of being currency manipulators and using unfair trade practices to dump goods. He wants to impose the tariff on USA companies operating overseas. This according to Trump will help America tackle unemployment, reduce the trade deficit and puts America First.

In doing so Trump is playing with fire which could have global repercussions. The USA has a trade deficit with 101 countries, the largest being with China, Mexico and Canada. And plucking any cord without thought would result in a trade war which would damage America as much as any other country. There exists a co-dependent relationship between all of these countries and the United States. In this symbiotic relation, if one changes the terms, the other will respond in kind.

China is the third largest importer, has the largest trade deficit and is the fourth largest exporter friend of United States. Today, China is the most rapidly expanding economy and to think that the USA holds all cards against would be heights of foolishness. It would be clearly inconsequential for a growth-starved economy such as the United States to declare a war on trade front with China. Most of the American fortune 500 companies find a large market in China and any retaliation would cause erosion of millions of jobs from the USA.

Apple, for instance, gets all its key components manufactured from China. It does so to keep cost to bare minimum. Moving away from China would kill the cost advantage and eat away the profits. Similar is the case with Chinese imports of Boeing (Aircraft, spacecraft) and Soybean (Oilseeds) which accounts for close to 35% of total USA imports to China. China holds close to $1.5 Trillion USA debt and asset securities. If they were to dump these it would send the Dollar crashing eroding equity markets and putting the federal reserve under inflationary pressure resulting in interest rate hikes. Couple that with low employment and low household spending, you lose a chunk of your GDP.

Mexico is the biggest imports and exports partner of the USA for auto parts, cars, buses and trucks. The automobile industry is the greatest of all that causes the trade deficit to bulge. If you take these away Trump’s dream of trade surplus with Mexico comes true. This auto industry has a production sharing program between the USA and Mexico that was a part of the NAFTA. It helps the USA companies maintain a price advantage and keep higher wage jobs back home. According to USA chamber of commerce close to 6 million USA jobs depend on trade with Mexico.

40% of parts in Mexican products originate in USA meaning for every Dollar of import with Mexico 40 cents land back in the USAA. Before a car reaches a dealership it has parts that have travelled between Mexico, USA and even Canada. Such is the effect of the production sharing program which was implemented since the NAFTA was enforced. This again results in the competitive cost advantage for USA car manufacturing companies over the European car manufacturers.

International supply chains today constitute about 80% of world trade. Cost advantages have made the companies go global adding value to goods in every step in many countries. Pulling a plug from this chain could disrupt entire production networks which are needless to say would spell bad news for everyone involved, be it directly or indirectly.

The world trade since globalisation has been laying its own path and if one person thinks he could undo the complex world trade structure, his claims must be folly. Trade-deficit prone USA economy needs a lot more than trade as a weapon of economic destruction which is a two-sided sword.

The symbiotic relation that the USA holds with its trade deficit counterparts needs to carefully tread which requires not just a unilateral but multilateral measure to revamp the struggling USA economy.

For more world news click here.