India’s second largest state-owned lender Punjab National Bank disclosed on February 14th, 2018 that it was the victim of the country’s largest bank fraud. PNB revealed that fraudulent transactions by billionaire jeweler Nirav Modi and related entities amounted to $1.77 billion or over Rs 11,000 crore.

In a complaint to the Central Bureau of Investigation, the bank said that Modi and the companies linked to him colluded with its officials to get guarantees or Letters of Undertaking to help fund buyer’s credit from other overseas banks. The funds, ostensibly raised for the purchase and sale of diamonds, were not used for that purpose, PNB alleged.

Later, it was revealed that the fraud extended past PNB to other lenders like State Bank of India, Union Bank, Axis Bank Ltd. and Allahabad Bank, all of whom had exposure to the case.

Modi, as it turned out, had left the country on January 1st, 2018. Now the CBI is trying to get him. They already approached the Interpol for help in locating Modi and his family. It also registered a fresh FIR against Mehul Choksi, Modi’s maternal uncle and the promoter of Gitanjali Group, who is also named in the fraud.

The Modus Operandi

Three firms—M/s Diamonds R US, M/s Solar Exports, M/s Stellar Diamonds— approached PNB for buyer’s credit to make payments to overseas suppliers. PNB’s objection said that preliminary investigations displayed two officials of the bank had illegally issued LoUs to the said firms without following the right process. These unlawful LoUs were then transmitted across the SWIFT messaging system, according to which credit was offered to the said firms.

Essentially, overseas banks were lending money to the firms being assured that PNB has them covered in case of a default. That’s wasn’t the case though.

PNB Management’s Defence

PNB held a press conference on February 15th, 2018, saying it would honor all bona-fide commitments. The lender took prompt action against its staff that failed to enter the correct information in the system and has asked Modi to submit a formal repayment plan, said Managing Director and Chief Executive Officer Sunil Mehta.

On Friday, The PNB management told investors that even if the bank has to reimburse the total sum loaned out to Modi, it won’t fall below the capital thresholds.

Who’s Liable To Pay?

The CBI would determine whether PNB is liable to repay the banks that loaned money to Modi-linked firms based on the public lender’s guarantees. In the top-case scenario, the client, in this case, Modi or his companies, would refund PNB which in turn would pay the banks that loaned out the funds.

But what if Modi can’t pay on time? Whose liability is it? PNB’s? Or the banks that loaned the money based on PNB LoUs? Click here to know more.

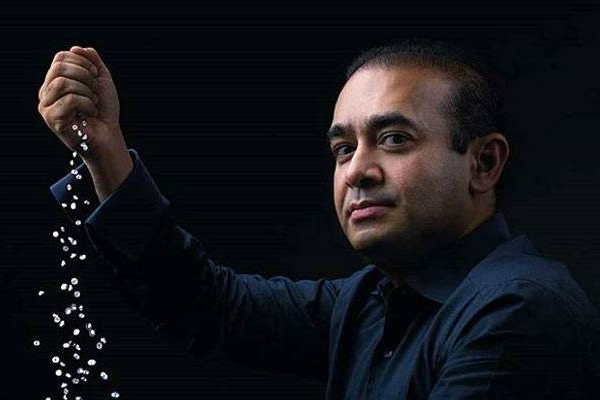

Who Is Nirav Modi?

Nirav Modi is a diamantaire and India’s 85th richest person. He is an elite jewelry designer and his creations have been sported by high-profile stars including Priyanka Chopra and Kate Winslet, who wore one at the Academy Awards this year.

Modi has 10 namesake boutiques across the globe, including two in the U.S., one in Beijing, two in Hong Kong and two in India.