GST – DECODED

The tax system in India:

The Government of our country levies taxes to fulfill the developmental needs of our country, meet public expenditure and ensure social welfare. These are broadly classified into direct and indirect taxes. The ones that are directly imposed on the citizens like Income Tax, Wealth Tax, Property Tax etc., and ones that are indirectly paid by all alike. Examples of indirect taxes are tax on manufacture (Excise Duty), tax on sales (Sales Tax), Value Added tax (VAT), and tax on Imports & Exports (Customs Duty). Each of these levies is governed by a special Act that lays down in its provisions the guidelines and compliance procedures. This form of charging multiple taxes on goods at various stages leads to a cascading effect making them costlier, thereby burdening the final consumer.

The Goods and Services Tax:

The Goods and Services Tax (GST) is a comprehensive indirect tax that will be levied on all transactions that include supply of goods and services, exchange, barter, sale for consideration, rental, lease etc., aiming to remove this cascading effect of taxes. The first step towards GST was taken in 2000 by the Vajpayee Government which set up an Empowered Committee of state Finance ministers, headed by Asin Dasgupta to form a model for GST and oversee the IT backend preparations.

The model GST law was put forth by the Empowered Committee of the State Finance Ministers last week. The draft outlines what the Act is going to be like but does not specify the rate of the tax

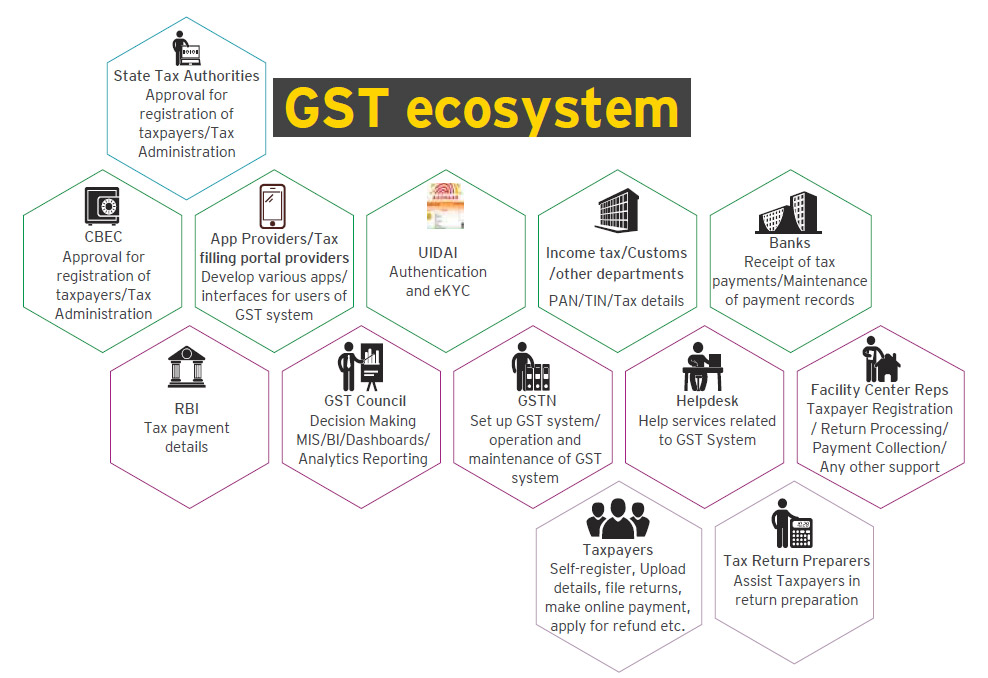

To begin with GST will apply to the whole of India and shall come into force when notified by the Central Government in the official Gazette of India. It would be both a central and state levy, called the Central Goods and Services Tax (CGST) and State Goods and Service Tax (SGST) respectively.

Significant features of the GST

- In contrast to the multiple tax laws across the states, GST will bring about a uniform tax system in India.

- By clearly defining what goods and services are and clarifying previously present ambiguity, this law eliminates all prospective loopholes to avoid taxation.

- The payment of tax shall be at the time of supply, which would be the earliest of either the time goods are removed by the suppliers for supply to the buyers are received by or the date on which the supplier makes the invoice or the date when the buyer makes the payment.

- GST would be applicable to both interstate and intra-state supply of goods and services.

- The tax would be charged on the transaction value of the goods or services supplied.

- Suppliers are permitted to make credit on input tax paid and deduct it from their final output liability to the government with a certain amount of conditions and provisions attached.

- All threshold limits of state levies will become redundant and a constant threshold of Rs.10 lakh will become applicable for the whole of India except the north-eastern states where it will be Rs.5 lakhs.

- Any unpaid tax shall attract an undisclosed rate of interest from the first day of such tax falling due.

- If a person wishes to get a refund, then the application needs to be made with the appropriate authority within 2 years of the payment. Also, in case the due refund is not paid within 3 months of application, the applicant is entitled to interest on refund due.

- All assesses will have to file periodical returns with the respective GST authorities.

- The law has also brought under its purview taxation for all e-commerce transactions, which some of the traditional taxation laws haven’t aligned to.

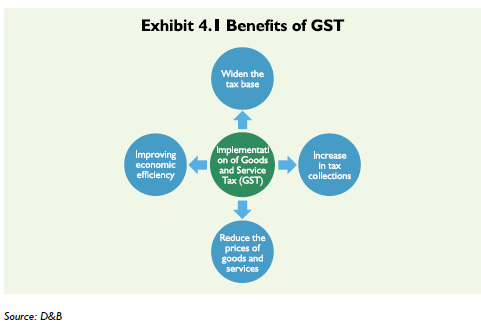

Though this will bring about uniformity in the indirect taxation system in India and lead to easier administration, benefit customers in the form of lesser tax amount and avoiding of double taxation, it also means increase in compliance requirements and complex procedures for assesses, especially the small service providers who will no longer benefit from basic exemption. GST is an offer* to the nation with its own *terms and conditions apply.