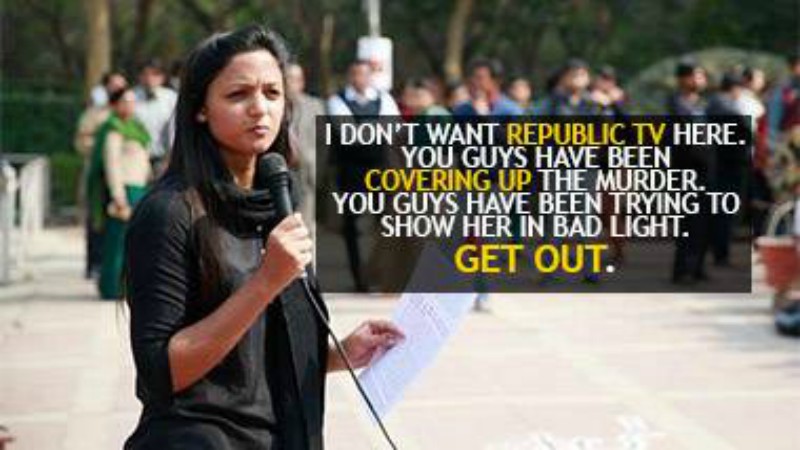

JNU Student Shehla Rashid Stops Republic TV Reporter

“Death of Gauri Lankesh is a political assassination “: Shehla Rashid claims, stops the republic TV reporter while reporting.

Although the video is of 2 minutes but took less than 2 hours to reaches to thousands of viewers. The viral video shows the JNU student and former JNUSU vice president Shehla Rashid’s interview while interrupting the REPUBLIC TV channel reporter for covering her voice on the death of senior journalist Gauri Lankesh in Bengaluru. She justifies her intrigued action of precluding the reporter by accusing the Republic TV channel to be biased.

“They hoard the funds from P.M. Modi’s government, covered the assassination of Gauri Lankesh, celebrate her death, justifying the perpetrators by stifling our voices: the voice of truth. Still, we are not afraid of such assassins we must gather on to streets to protest in an organized and united way to outrage collectively. We will portray our strong message in the banners stating I AM GAURI LANKESH that we bluntly condemned the celebrations are going” – her words.

She admires the Gauri Lankesh way of journalism. “One has to learn journalism from Gauri Lankesh, as she was not a voice of one party. The bullet, which stifles her voice forever, is shot to target to all of us who acknowledge the audience with truth regardless of which political party regime you belong. The central government is scared and a coward to face such prominent and strong profile journalist as their words create an unprecedented impact in the society. We are challenging the perpetrators to come onto the Jantar Mantar, interrupts our protest, try to inhibit our protest with all our weapons on day light, try to kill all of us in day light without getting shelter of dark night, we are not afraid yet”

The short 2 minutes video took coverage of all her expression, views and opinions on Gauri Lankesh incident. The video grabs the country’s political interested audience attention especially the P.M. Modi followers on twitter and YouTube.

The kind of attention her action is achieving was quite shocking. During her interview when she was questioned about the soft target by Indian media, she replied that the central government is clearly scared of her because when Nirmala Sitaram became the defense minister then also they are comparing myself with her even though I am just a student. So they are anxious about me, scared of me because we do not hesitate in addressing the truth to the audience.

“Although Gauri’s challenging words and accusation on the party was not a new incident but still, she was targeted a lot and we must know that more than 50% of country’s citizen choose P.M. Modi as their Prime minister. Therefore, who so ever tries to bully them will face the threat and seek the BJP follower’s attention, as they are currently more in numbers,” added Shehla.

The best example had taken place recently with one of the senior NDTV reporter Ravish Kumar report the ground news of protest of press club India in Delhi. Ravish Kumar itself was forced on the twitter to apologise for the words he used on to the P.M. Modi during his coverage.