Renowned Astrologer Predicts Gender Of Virushka’s Baby

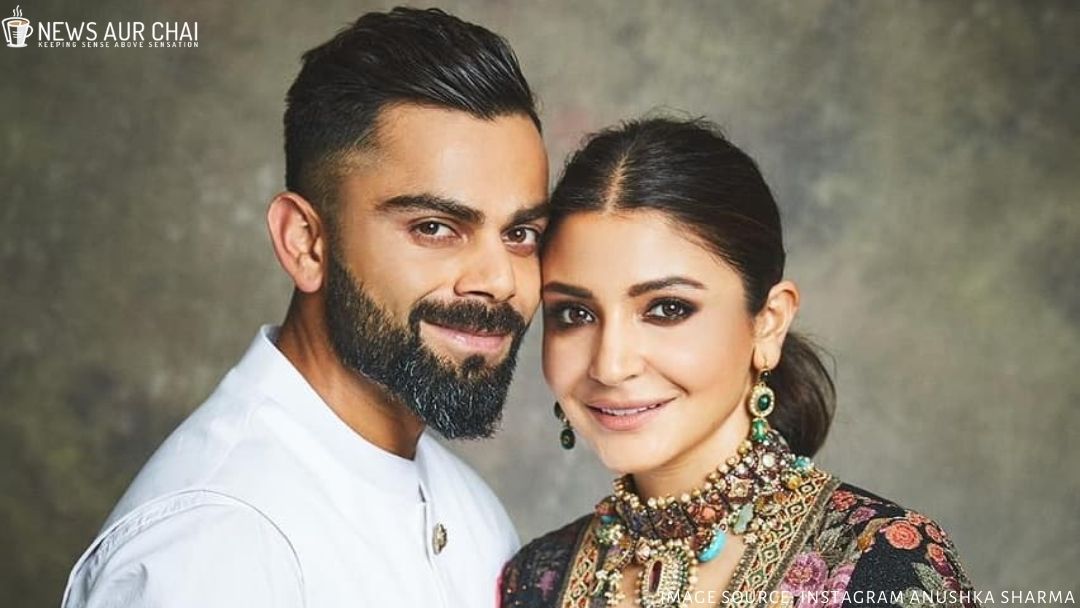

The power couple Indian Skipper Virat Kohli and Actress Anushka Sharma shared the delightful news regarding the entry of a third member in their family on August 26th. Both took to their social media and shared the good news also gave their fans a hint of the arrival of the baby, which is in January 2021. They dated each other for several years, and after three years of marriage, they are now expecting their first child. As soon as Virushka shared this news fans just couldn’t stop with congratulatory messages/comments.

Anushka was last seen in Movie Zero with Shah Rukh Khan where else, Papa Kohli will be seen in the next edition of Indian Premier League(IPL), season leading the Banglore team in Abu Dhabi. The 13th edition of IPL is scheduled to begin from September 19 across three venues, namely Dubai, Abu Dhabi, and Sharjah. After serving a mandatory six-day quarantine period, Virushka had celebrated the happy news with RCB players by cutting a cake.

Recently, a renowned astrologer Pandit Jagannath from Bangalore predicted whether the lovely couple will have a baby girl or boy. Based on a face reading of Virat and Anushka and astrological calculations suggest that the couple are most likely to be blessed with a baby girl. He added that be it a girl or a boy; both are God’s blessing, and girls now outshine boys in many fields. Guruji is a famous astrologer, prophesier and philanthropist, who has been a guiding light for scores of people over the past 25 years.

In an exclusive interview on the Royal Challengers Bangalore YouTube channel, Virat expressed his fleeing of being a father for the first time. He stated that, “It is a beautiful feeling. It puts things into perspective for you. It is difficult to describe how you feel, but when we found it, we were over the moon. The kind of love that was showered on us when we announced it was amazing. People were genuinely so emotional and happy for us. We are looking forward to the third member joining the clan.”

This is the second baby announcement from Bollywood after Saif and Kareena announced their that they were expecting a second baby.

As soon as the announcement came, the Twitterati went crazy and started the trend of memes on Taimur now being less popular or losing the limelight.

Taimur right now 😂 pic.twitter.com/aq9A1jqMQy

— Bhuvan Bam (@Bhuvan_Bam) August 27, 2020

*When you see Taimur is also trending along with #virushka * pic.twitter.com/BkSPNx0PAV

— Shivani (@meme_ki_diwani) August 27, 2020

#virushka

Virat and Anushka announced their baby birth in January.Meanwhile taimur* pic.twitter.com/NY2uM29pS1

— Memer Singh☢️ (@Hrajput_17_) August 27, 2020

First Hardik Pandya and then

Saif & Kareena Kapoor and

Now #ViratKohli & #AnushkaSharma

Taimur rn: pic.twitter.com/F5DSyKIDFJ— PunChaayat (@PChaayat) August 27, 2020

https://twitter.com/Ubharta_Daaktar/status/1298865712837128192?s=20