#OneNationOneTax – GST Passed in Rajya Sabha

“IT WAS 1991 AND NOW IT IS 2016 – THE NEXT REFORM IS THROUGH GST BILL IS PASSED”

It was precisely the 24th day of July 1991 that the then Finance Minister of India Dr. Manmohan Singh had ushered in an era of reform since the Nation had Independence. It was more than befitting that the GST – the GAME CHANGER OF THE ECONOMY – is passed in the month in which India got Independence.

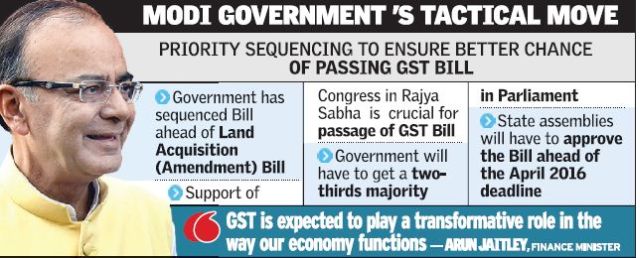

The maturity of the discussion between Mr. P.Chidambaram and Mr. Arun Jaitely was to be seen and heard. It was one of the days in the parliament that it functioned in such a matured manner to usher in ONE NATION ONE TAX policy. The political will and sagacity and the undisplayed unanimity were present right through. The discussions were healthy and were made keeping nation in mind rather than the political outcome of such event

The youth of today is eagerly awaiting the nation’s development. It is the only process through which he or she can get employment. The bloodshed, the corruption, the political one-upmanship is what has been seen by the youth of today. The Government of the day mustered enough strength and was more considerate towards the developmental views of the opposition parties. That was the only reason for the bill to have seen the light at the end of the day.

So far, the citizen of India has been made to suffer the cascading effect of taxation and it has gone to increase the cost of the goods and services. The Constitution 122nd Amendment bill had ensured that the States and the Centre will and have a simultaneous power to make laws governing goods and services and that will help the final consumer in paying less tax than what he has been paying now in a consolidated form.

The Additional excise duty, the vat, the CST, the countervailing duty, the special additional duty of custom, the octroy, the entry tax, the purchase tax, and the luxury tax will now be consolidated into one tax name GST.

The availability of claiming cross input tax credit between the goods and services, the ease of registration, the one return filing are a boon to the manufacturers, the wholesalers, and retailers.

The Central and the State governments will have better control over the leakages in the system. The administration of the act will also be easy. These will lead to higher revenues to the both the governments.

The Kelkar Task Force suggestions in the year 2003 and the mooting of such an act in the budget of 2006-07 has finally seen the light of the day. The Empowered Committee of State Finance Ministers has been assigned the unenviable of a task of preparing a design and road map for the implementation of GST. And that the EC has done a commendable job.

The GST bill has been passed, the game-changing economic reform has indeed taken place.