Finmo | UPI Enabled Mobile Banking App

Have you ever faced the problem of putting the account number, 11 digit IFSC, branch details and what not just to do a transaction through your bank account to your friends or relatives, or putting the Debit/ Credit Card details to make an online transaction while shopping on Amazon or booking a ticket on BookMyShow, then you, my friend, are at the right place, and reading the right blog.

This April 2016, Dr. Raghuram Rajan, the then Governor, Reserve Bank of India (RBI) announced the launch of UPI (Unified Payments Interface) earlier this year in April, along with Mr. Nandan Nilekani, Advisor to NPCI (National Payments Corporation of India), Mr. Balachandran M., Chairman, Mr. A P Hota, MD & CEO and Mr. Dilip Asbe, COO, NPCI in Mumbai. With this announcement, India moved a step closer towards becoming a cashless economy with the advent of digital payments. Finmo is one of the earliest private companies planning to enter the space with its own functionality rich UPI enabled mobile banking App.

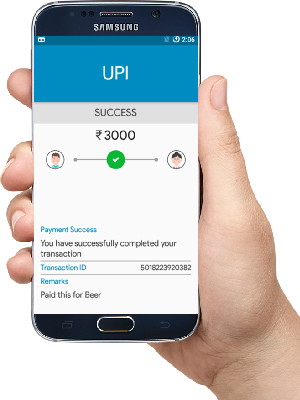

Finmo is a free mobile banking App powered by UPI (Advanced version of IMPS) allowing people to use their money freely and securely. With Finmo, people can send or request money instantly, from just about anyone, be it a friend or the local vegetable shop in your locality, just by using a unique virtual ID – VPA (Virtual Payment Address)

Virtual Payment Address is just like your Email ID, something of the form yourname@xyzbank, like sachin@sbi or salman@citi. No more hassle of entering the account number, IFSC, and other beneficiary/payee details. On entering just this VPA and authenticating the transaction with your MPIN, you’ll be able to complete a successful transaction in under 10 seconds.

Finmo is much more than just a money transfer app. You can split bills and pool money with your friends, and comes in with an integrated strong expense management and budgeting tool, helping you track and keep a check of your expenses and set & achieve your goals. You can also use Finmo to pay your electricity bills or recharge your mobile, DTH etc. The secret sauce here is the Social Feed, where you’ll basically get to peek at who’s spending together and on what, and also not just transact, but also have a chance to converse with your dear friends since we believe that Transactions become Experiences and Experiences become Conversations.

We wish to create an entire ecosystem where all your finances are managed within a single app, like Facebook is for your social life, Linkedin is for your professional life, we want Finmo to handle your financial life. Big task, isn’t it?

The digital payments space is getting exciting everyday with lots of innovation and we want to be a part of this disruption. Finmo plans to enter into following areas:

- Merchant Payments

- Payments for Insurance Premium

- Payments for Mutual funds

Exciting enough? Join our waitlist at www.finmo.in to be part of the biggest digital revolution of India.