Yes Bank, founded by two foreign banking professionals Rana Kapoor and Ashok Kapur in 2003 had done well for itself by becoming India’s fourth-largest private-sector lending bank. On March 5, 2020, RBI had put Yes Bank under moratorium (prohibition on all its activities related to lending) along with capping on its maximum withdrawal amount to Rs 50,000.

This came as a shock to the banking sector that Yes Bank was involved in the case of money laundering. The crises started long back when RBI had raised eyes over its lapse of corporate governance and poor quality of bank’s loan books.

The aggressive lending done by Rana Kapoor, the CEO to companies like–Cox & Kings, CG Power, Cafe Coffee Day, Altico, IL&FS, Dewan Housing Finance, Jet Airways and others shows the bank’s exposure to lending to clients which have shown a trend of a high amount of NPA’s in their record. These investments turned out to be bad decisions.

The Enforcement Director had earlier called Ravneet Gill, the former MD and CEO of Yes Bank concerning Rs 3700 crore investment made to Dewan Housing Finance Limited (DHFL) which had earlier been involved in a scam with PMC Bank. Gill had served as the managing director and chief executive officer under Kapoor.

As per ED Officials, Yes Bank founder Rana Kapoor, who along with his family members owned 78 shell companies, was the one who handled and controlled the affairs of these companies.

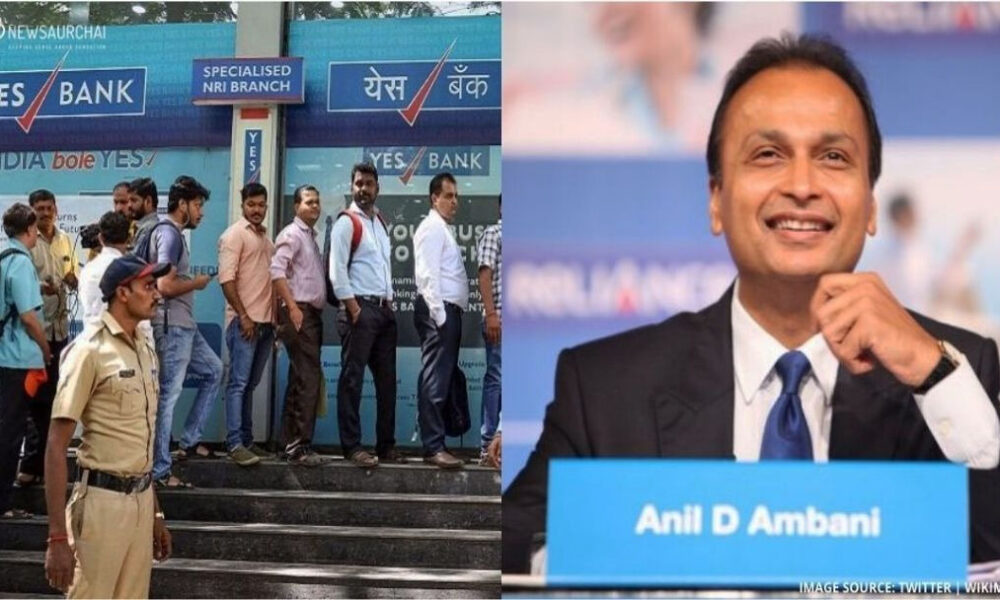

Following up on this, ED also summoned Anil Ambani to its office in Mumbai. His companies are one among the largest entities who have taken loans from the Yes Bank which later turned out to be as NPA. The amount of loan is estimated to be about Rs 12,800 crore which the Ambani’s group borrowed from Yes Bank.

Sameer Gehlaut of IndiaBulls has also been summoned on March 20, and Avantha Realty promoter Gautam Thapar has been summoned on March 21. On March 16, Indiabulls Housing Finance Ltd (IHFL) said that Sameer Gehlaut or any company related to him or his relatives had no loans outstanding from YES Bank. On March 15, IHFL had clarified that the company, as well as its promoters, do not have any outstanding term loan from YES Bank.

Essel Group Chairman Subhash Chandra is summoned appear at the ED office on March 18.

In a statement, the company said that most of the credit facilities were fully secured also were availed for its infrastructure business and not in the media firms. The company also made it clear that the group had never made any transactions with Rana Kapoor, his family, or any private entities controlled by them.

Finance Minister Nirmala Sitharaman had highlighted Ambani Groups, Essel, ILfs, DHFL and Vodafone among the stressed corporates who borrowed from Yes Bank.

The government came forward with the reconstruction plan to revive Yes Bank along with SBI, who showed a willingness to participate in the investment process. This is the first time witnessing SBI with more than over Rs 34 lakh crore asset size coming forward to bail out a bank.

As per the reconstruction plan, the investor will have to invest up to 49 per cent stake in the bank and will have to buy the Yes Bank share at 10 rupees which include 8 rupees as premium and 2 rupees as face value. The investor bank will have two nominee directors and RBI will also appoint a director on the board. There will be a change in the Articles of Association too.

As on March 18, Yes bank’s share jumps 50 per cent in the trade as the bank is expected to resume full banking services from 6 pm later in the day.

Yes bank CEO-designate Prashant Kumar stated there are absolutely no worries on the liquidity front and that complete operational normalcy would be restored from 6 pm on March 18. He also assured depositors that if there is too much of rush, the bank will be opened on weekends as well.

As per the reports, it is expected that the crisis-hit bank might see a substantial withdrawal of deposits by customers as soon as the services resumed. However, Kumar stated that as per customers feedback and looking into the inflow and outflow ration, it won’t be the scenario.

Yes Bank is in dire need of capital infusion; at this point, the future of Yes Bank Depends on RBI and SBI with no other bank coming forward to invest in it.