Decode GST – Ups And Downs of GST

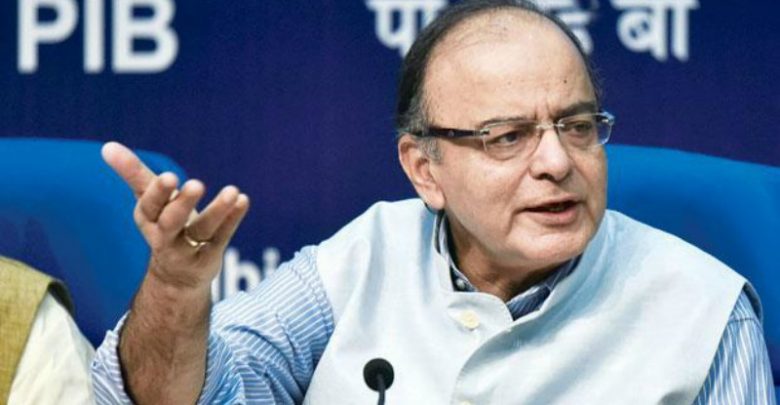

India culminated a game-changing proposal by bringing in the goods and services tax (GST) with a four slab taxation structure of 5%, 12%, 18% and 28% decided by the GST council. As asserted by the union finance minister Arun Jaitley this would not burn the pockets of the common man.

The highest of 28% will be applied to 5-star hotels, cinema tickets and gambling or betting at race course bringing in flak from these industries. This especially applies to hotels with a price tag of over RS 5000 a day. Hotels with tariff less than RS 1000 are exempted from GST. Eating at non-Ac restaurants will be charged with 12% GST on food bill and AC Restaurants with a liquor license will be charged with 18% of tax. It should be taken into note that not all hotels charging over RS 5000 are 5-star hotels. This would only slow down the tourism industry with major cuts in jobs leaving people unemployed. However, this resolution will give a momentum to smaller budget hotels of the country giving leverage to middle-class families on holidays.

Other restaurants with turnover below 50 lakhs will be charged under 5% slab. Cinema lovers, on the other hand, can rejoice by the coming down of movie tickets as the highest tax of 28% is still less than the current 45% and 55%, but we still have to see the taxes imposed by the state, local governments and municipal taxes which may increase the prices.

Most unaffected will be the education and healthcare sector which is exempted from the upcoming GST regime, while other services like the transport, economy class airfare and small eateries or dhabas come under the lowest scheme of 5%. This would reduce the rising inflation on food items and transport industry where App based services like Ola/Uber are also included. As per Piyush Goyal, the minister for power and coal said that 5% slab on coal will make it more affordable for the poor and farmers reducing corruption and bringing in transparency. The most amount of pressure will be felt by the market under the 18% bracket including banking, financial services and insurance sector. This will result in monthly premiums and a broadband bill to shoot up. E-commerce companies will face 1% tax collected from the source. Meanwhile, the default rate for services under GST would be 18%. The rate of 18% is still higher than the current 15%levied at present, but the actual incidence of the tax may be lower as the service provider will be getting credit for taxes paid on the goods used for the provision of services as said by Jaitley. Although many products will be seen with shrunken prices and tax benefits including toothpaste, soaps, trucks, small cars, SUV’s and AC trains. These are provided with single national sales tax collected on all India basis.

GST is adopted by over 135 countries with different variances in their approach. Countries like Canada and New Zealand have shown extensive revenue growth in the past couple of years. In India, we still see paucity in state level taxes. Currently, most products face central excise duty of 12%, infrastructure cess of 2.5%, national contingency and calamity duty of 1%, value-added tax of 12.5%, entry tax and central sales taxes. Now all of these taxes will be replaced by GST and cess added to it bringing down the overall price burden. The council’s next meeting is in New Delhi on June 3. They will decide tax rates for remaining commodities – Gold jewellery, packaged food and clothing among a few. Except for a few undecided rates of items the GST regime is ready to be rolled out on July 1.